Indecision can be the most challenging obstacle to gaining clarity. It often takes either an active or passive role in our pursuit of goals. While there’s always the possibility of loss if our objectives aren’t entirely clear and we opt for the less profitable path, there are times when we can’t see the full scope of a situation and need to take a risk. The emergence of new technologies consistently reshapes job markets, prompting many to realize they must acquire new skills to stay relevant. While it may be concerning that millions of jobs are at risk of disappearing, it’s also true that technologies like robots and artificial intelligence will create numerous new opportunities.

It’s not just about motivating people out of their comfort zones; it’s about shining a light on the potential for countless individuals to explore and establish new horizons. We ponder how to optimize crucial aspects of our lives, such as personal finances and the sustainability strategies that keep businesses afloat. This exploration is essential, especially in the face of impending socioeconomic and technological shifts over the next few years. These changes are already emerging across multiple industries, as we’ve seen in our discussions on e-commerce, a sector experiencing continuous growth that increasingly demands more flexible supply chains. Technologies like cryptocurrencies and artificial intelligence will play a significant role in the sector’s evolution, helping to anticipate consumer preferences and enhance feedback with customers.

If taking that first step seemed difficult to you, but now you see the long-term potential of Bitcoin and cryptocurrencies and have decided to trust, you’ll be pleased with the upcoming reading. The crypto world is fascinating, offering versatility and incredible freedom, but it also requires individual guidance and responsibility. While the idea of fast, secure transactions with no middlemen and the deflationary effect on your money may be tempting, remember it also requires dedication and care on your part. In the crypto world, there’s no centralized authority to turn to for help if you make a mistake. However, as we discussed in our previous article about using cryptocurrencies in a small business, the challenges, while daunting for newcomers, are not impossible to overcome.

First, what is a cryptocurrency? It’s a digital asset built on cryptographic encryption, the science of designing procedures to encrypt confidential information. The foundation of this entire system began with the arrival of Bitcoin in 2009, highlighting a fundamental human need: the desire to keep certain information secret and share it only with specific groups. This concept is well illustrated by historical examples, such as during wartime when the element of surprise could determine a military advantage. Modern cryptography emerged during World War II, influenced by the work of mathematician Alan Turing.

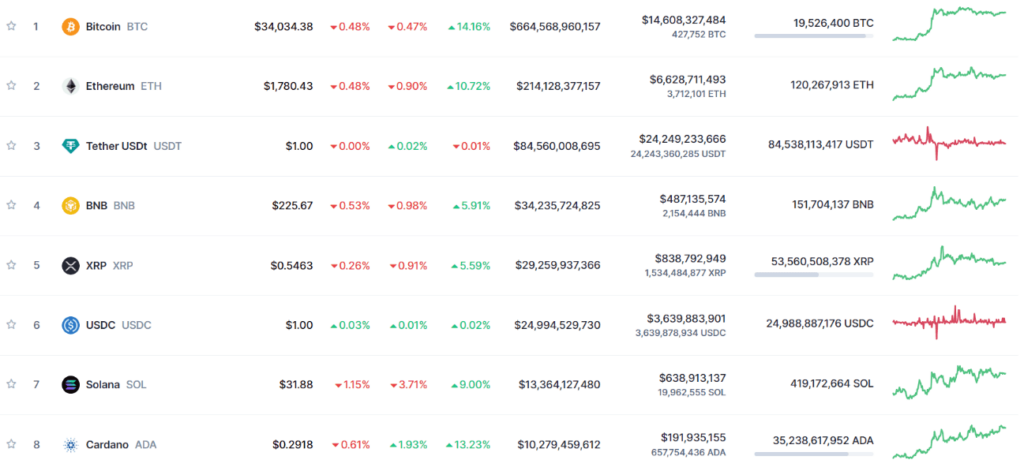

How many cryptocurrencies exist? Quantifying that is quite challenging. You can access a list of over 8,000 crypto assets and view their market capitalization, although some sources suggest there are over 10,000. Why are there so many projects? Well, because almost anyone can create a cryptocurrency. What sets them apart is the technology they use. Blockchain, the digital framework that powers cryptocurrencies, offers tremendous potential for various applications. It simplifies logistical processes, streamlines public administration, reduces the risk of voting fraud, enhances efficiency in managing intellectual property records, and can even be used for something as ‘simple’ as security monitoring in a building. Blockchain’s contributions extend to healthcare, where it transforms the management of medical records and enhances communication among patients, specialists, and insurance companies. It also benefits real estate, maintaining property databases and facilitating sales. Moreover, it plays a crucial role in entertainment, with many artists using NFTs to offer digital art and gain more support from their fans. And, as we’ve highlighted in a previous article, it significantly influences DeFi finance and the e-commerce industry.

Some concepts you need to know:

Token: a unit of value similar to a coin or a casino chip, representing an amount of money. Let’s take a look at the acronyms associated with standard tokens: ETH for Ethereum, BTC for Bitcoin, and SOL for Solana, to provide a few examples.

Altcoin: short for “alternative coin”, refers to cryptocurrencies that emerged after Bitcoin. These coins, like Bitcoin, serve as ways to retain value and means of payment, but they also come with unique features such as distinct mining algorithms. Examples of altcoins include BNB, Dogecoin, Polygon, Litecoin, USDC, Ethereum, and USDT, among others.

Differences between cryptocurrency, tokens, and altcoins are a common source of confusion for beginners. Let’s clarify it for you. First and foremost, people often use the term “cryptocurrency” to describe nearly any digital asset, but it should specifically refer to projects that have their own Blockchain, such as Bitcoin and Ethereum. It’s worth noting that the concept of tokens is closely related to that of cryptocurrencies. For example, ETH is generated on the Ethereum Blockchain, while CAKE operates on the Binance Smart Chain. Having made this distinction between cryptocurrency and tokens, it’s important to understand that not all tokens qualify as altcoins. Similarly, not all tokens can be classified as cryptocurrencies; only those issued on their native blockchains hold that distinction.

Sidechain: an alternative Blockchain designed to enhance the performance of an existing one, improving efficiency. While it employs different programming, it remains compatible with the original Blockchain, enabling a secure link for faster transactions. Sidechains facilitate cross-cryptocurrency transfers, such as from Bitcoin to Ethereum.

DApps: short for “Decentralized Applications”, are apps that operate without third-party control, enabling users to interact through Blockchain technology. Let’s take WhatsApp as an example. When we send a WhatsApp message to a friend, it goes to Meta’s servers, where metadata about our communications is stored before reaching its destination. In the world of DApps, the main idea is the absence of a central authority, with data records distributed among users themselves.

Stablecoin: is a digital asset type issued through smart contracts, primarily designed to maintain a 1:1 parity with the value of the US dollar. Stablecoins can be backed by fiat currency, or other cryptocurrencies, or exist as hybrid projects, among other variations. We recommend reading this note for further details. Some of the most commonly used stablecoins include USDT, USDC, DAI, and TUSD.

Smart Contracts: these are sequences of instructions stored and executed within a Blockchain. These scripts mirror the terms of a particular contract and serve as programs that, while leaving a verifiable record, don’t expose the identities of the involved parties. They were created to streamline processes and remove intermediaries. You can find more information in this note.

Wallet: is essentially a portfolio that allows you to manage your cryptocurrencies, and its main elements are the public and private keys. The public key serves as the cryptocurrency address that you can share with clients and friends for receiving transfers, while the private key is a data sequence that ensures access to your funds. Prominent digital wallet or hot wallet choices include Atomic Wallet, BlockWallet, and Exodus, among others. On the other hand, physical wallets or cold wallets are produced by manufacturers like Ledger and Trezor. For additional details, we encourage readers to check out the following post.

Exchange: is a platform that allows users to purchase, sell, and trade cryptocurrencies, conduct transfers, participate in staking (locking certain cryptocurrencies to earn rewards), and perform a range of other transactions.

NFT: short for “Non-Fungible Token”. These are unique digital assets that can’t be swapped for others of the same type. Think of it like a piece of art in your living room; each one is distinct and valuable in its own way. NFTs work similarly and have become quite popular lately. Anyone can create an NFT on platforms like OpenSea. In simple terms, think of NFTs as digital collectibles, often including items like images, videos, or music pieces, typically recorded on the Ethereum Blockchain.

How to buy cryptocurrencies? Where to do it?

You can purchase cryptocurrencies with regular fiat currency on centralized platforms like Binance, Coinbase, Kraken, and Bitfinex. Some virtual wallets, such as Trust Wallet and Atomic Wallet, also facilitate these transactions. Additionally, there are decentralized exchanges like Uniswap, ApeX Pro, KyberSwap, Bancor, and OKX DEX that operate independently. However, please be aware that some of these services, while reputable and offering competitive features like staking and farming, don’t support fiat transactions, may have less user-friendly interfaces, and offer limited trading options.

For those new to the cryptocurrency world, it’s often simpler to start their cryptocurrency purchases on a centralized platform. This is quite understandable since these services, like Binance, are popular and user-friendly. However, as we’ve stressed in previous discussions, a common mistake is to assume that your funds should remain indefinitely on such platforms. We recognize that the cryptocurrency space can be intimidating, and everyone learns at their own pace. Still, it’s crucial that, as you take your first steps, you also begin to educate yourself about digital wallets and hardware wallets.

Cryptography and cryptanalysis have played vital roles in numerous crucial moments of history, but the emergence of cryptocurrencies represents the most significant and daring advancement in this realm. This area encompasses a diverse range of disciplines, blending finance, and computer science, emphasizing the need to stay informed. Cryptocurrencies deliver innovative solutions, offering high levels of security, speed, and transparency. They serve as robust defenses against inflation and modern economic challenges while propelling us toward financial independence.

Could you ask for more? I think not. Or maybe you can. It’s quite likely that your journey so far is valuable enough to desire a project with our seal. Let me explain: You won’t just be acquiring cryptocurrencies using the methods we’ve discussed. You’ll also have the option to engage with an open-source alternative that leverages the power of smart contracts, empowering users to actively participate in the ecosystem’s governance.

If you’re not content with standing still and wish to apply your newfound knowledge to safeguard your crypto assets, the LOAD protocol will offer you new and exciting tools. This forms the foundation of a platform that aims to boost the LOAD token through rewards and also paves the way for businesses operating in the Web 2.0 space to comprehend the true potential of Web 3.0, also known as the third generation of the Internet or “decentralized web”. It’s all about enabling applications to interact via decentralized protocols and giving users greater control over their data. This is why we mentioned DApps. The vision is for everything to operate more democratically and transparently. It’s that straightforward.