Latin America often grabs headlines in the international press, typically for two reasons: its vibrant cultural scene and, unfortunately, its politicians’ tendency to mismanage public affairs. Although this isn’t uncommon globally, it’s particularly conspicuous in Latin American nations. Countries like Venezuela and Argentina have been stuck in economic crises for as long as many can remember, while others such as Colombia, Bolivia, Ecuador, and Peru struggle to achieve lasting growth. In the end, it’s ordinary citizens who bear the consequences of political decisions: people who wake up each morning to run their small businesses or rely on public transport to get to work.

When faced with laws that stifle progress and freedoms, it’s only natural for people to seek refuge. As Juan Bautista Alberdi, father of the Argentine constitution, once said: “Societies that expect happiness from their politicians are expecting something contrary to human nature”. While individuals have a social and communal side, they inevitably prioritize their own interests. Alberdi’s observation rings particularly true for Latin America, where this dynamic has been prominent for decades. However, as we highlighted in our discussion on decentralization in e-commerce, human action persists despite barriers and limitations. This is where cryptocurrency takes center stage.

In recent years, there has been a skyrocketing adoption of cryptoassets in Latin American countries. While there’s still plenty of work to be done, with many skeptical about alternatives to fiat currency, there’s undeniable progress. In September 2021, El Salvador made headlines by becoming the first nation to officially adopt Bitcoin as legal tender. This has allowed the emergence of initiatives like “My First Bitcoin”, an educational project empowering individuals by teaching about crypto. Change is a slow process, but this team is determined to see it through.

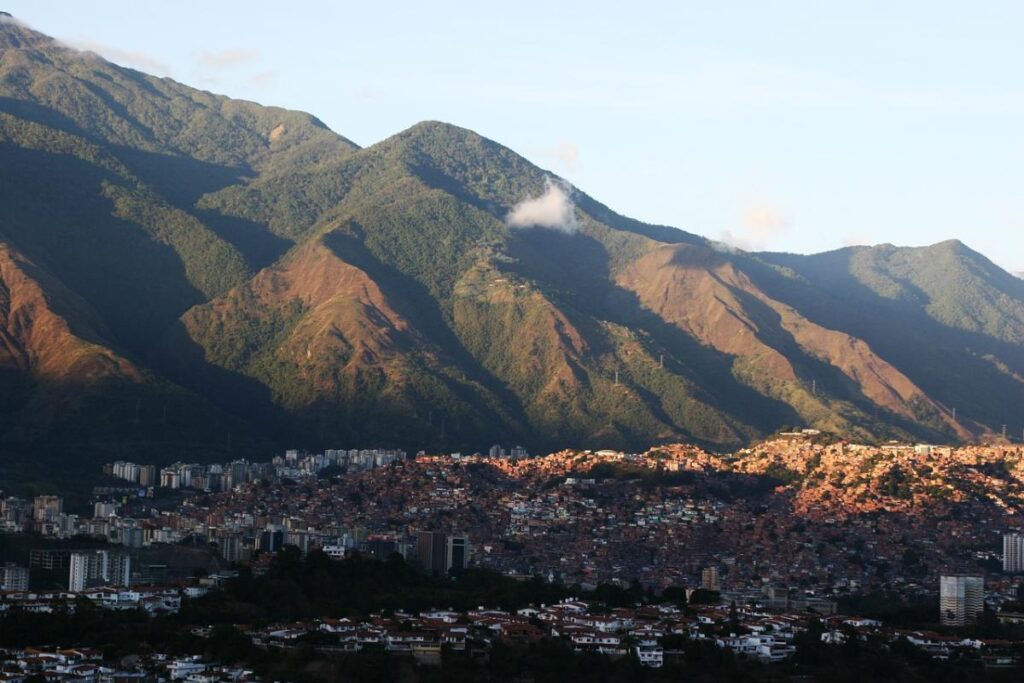

Venezuela is an interesting case, even though cryptocurrencies aren’t officially recognized as legal tender by the authorities. In 2018, the country hit rock bottom after years of severe economic crises, with inflation soaring over 80,000% year-on-year. As a result, salaries and pensions in bolivars evaporated, pushing many into poverty. This dire situation spurred widespread interest in cryptocurrencies among normal people, who began to explore Bitcoin, stablecoins, and mining. Today it’s quite common to see small businesses across Venezuela accepting crypto payments, especially assets like USDT and USDC through Binance.

Let’s stick around in Venezuela for a while longer. Unlike smaller ventures, it’s rare to find big companies like popular clothing chains or supermarkets that accept crypto. Instead, these big-name businesses usually prefer payment methods like Zelle and Western Union. Additionally, it’s worth mentioning that some startups insist on payments via Tether (USDT) rather than accepting cryptocurrencies like BTC or LTC.

“Today, cryptocurrency adoption in Venezuela keeps growing, driven by the need to store value and receive remittances. It’s all about the future, about bringing people into the global market without the need to migrate. You could have a job and get paid from anywhere in the world without any restrictions”.

Leopoldo López, a prominent opposition leader.

In 2018, the Venezuelan government rolled out the “Petro”, a digital currency to revitalize the nation’s ailing economy. However, the project was fraught with controversy from the beginning. Many aspects of the initiative were ambiguous, fueling widespread distrust among the populace. Consequently, citizens turned even more to the most popular cryptocurrencies, which continue to attract global attention today… The “Petro” ultimately floundered.

Venturing beyond Venezuela’s borders, Colombia shines as one of the largest crypto communities among spanish-speaking countries. According to the Mexican exchange Bitso, the number of Colombians showing interest in crypto assets surged by 60% in 2023. Their report revealed fascinating insights, such as Colombians favoring Bitcoin and an impressive 33% of Bitso’s portfolio in the country being women. Moreover, the data underscores Colombia as one of the nations with the highest adoption rates of stablecoins.

As mentioned earlier in this article, Argentina has been grappling with economic crises for several decades, stretching back over a century. The latest crisis began to unfold in 2018, marked by a surge in the dollar’s value which, after nearly six years, began to taper off last January. Consequently, citizens witnessed a steep decline in their national currency’s value (the Argentine peso). To put it into perspective, in 2015, one could exchange a USD dollar for 9.8 pesos at the official rate, and today the exchange rate stands at one dollar for 926 pesos (on the black market, a dollar can be traded for 1,065 pesos at the time of writing). Similar to Venezuela, the middle class bore the brunt of this economic turmoil, leading to a surge in crypto’s popularity.

The similarities with the Caribbean country don’t end there. In Argentina, accessing imported goods is challenging due to numerous government restrictions. As a result, seeing a wide range of items imported from abroad is not very common, especially at a rapid pace. Small and medium-sized business owners tend to be selective about what they import, particularly when it comes to products like computers, smartphones, VR devices, and game consoles. Similar to Venezuela, these entrepreneurs are more inclined to accept cryptocurrencies as payment compared to bigger corporations.

However, Argentina’s prospects could change significantly as the current government’s flagship legislation, known as the “Ley Bases”, is being debated in the Senate. This amendment, which tackles asset declaration including cryptocurrencies, was initially proposed earlier this year by President Javier Milei. However, due to difficulties in garnering support from other political factions —the president holds a minority in both chambers: deputies and senators—, the crypto section had to be withdrawn… Despite this change, the project was not approved. Nonetheless, Milei remains determined and recently reintroduced the crypto section in a new version of the law, which received the green light a few days ago from the Chamber of Deputies. This initiative would enable crypto use without tax implications, provided the amount does not exceed $100,000.

Here are some additional fascinating insights into crypto adoption across Latin America:

- Lemon’s report titled “Argentina: Crypto Capital: State of the Crypto Industry 2023” reveals that over 40 million people in the region own cryptocurrencies.

- In a March report, MasterCard highlighted that annual remittances in Latin America have outpaced the global average by 10%. They also anticipate digital transfers will surpass traditional cash remittances to the region by 2024.

- El Salvador leads in Bitcoin ATM availability in Latin America, boasting 215 machines. Mexico follows with 75, Colombia with 48, while Brazil and Argentina each have 9.

- The 4th Chainalysis Global Crypto Adoption Index, released in September 2023, features Brazil, Argentina, and Mexico prominently. They rank 9th, 15th, and 16th in the overall index.

Latin America faces economic and political challenges that affect its citizens, who are constantly seeking alternatives to protect themselves from inflation and corrupt governments. While there are undoubtedly remaining barriers and mistrust, educational initiatives such as those offered by “My First Bitcoin“, and changes such as the recent debate about cryptocurrencies in Argentina, point towards a greater crypto consolidation in the region.

Don’t forget to follow us on X to stay updated on our team’s exciting projects. We share updates on crypto events and Hamza.biz, the pioneering Web3 e-commerce platform fueled by the Loadpipe protocol. Click here to explore the roadmap we’ve crafted for Hamza.